Personal Tax Services

Our personal tax services include:

- Annual income tax reviews to ensure that you are not liable to fines or penalties.

- Reminders throughout the year about the 31st January Personal Tax deadline.

- Self-assessment tax services to ensure that your regulatory compliance obligations are met.

- Preparation and filing of your personal tax return, including collection of information from you and online filing to HMRC.

- Handling of claims, allowances, and dispute resolutions.

- Personal tax advice to minimize your tax liabilities.

- Preparation of capital gains tax computations and submission through the relevant HMRC portal.

- Advice on all tax liabilities and when they are payable.

- Capital gains tax planning to minimize tax liabilities.

- Inheritance tax planning when required.

Accounts

We offer accounting services for small, medium, and large businesses, including:

- Preparation of statutory accounts

- Management accounts (if required)

- Company secretarial support

- Bookkeeping advice and support

- Accounting software advice

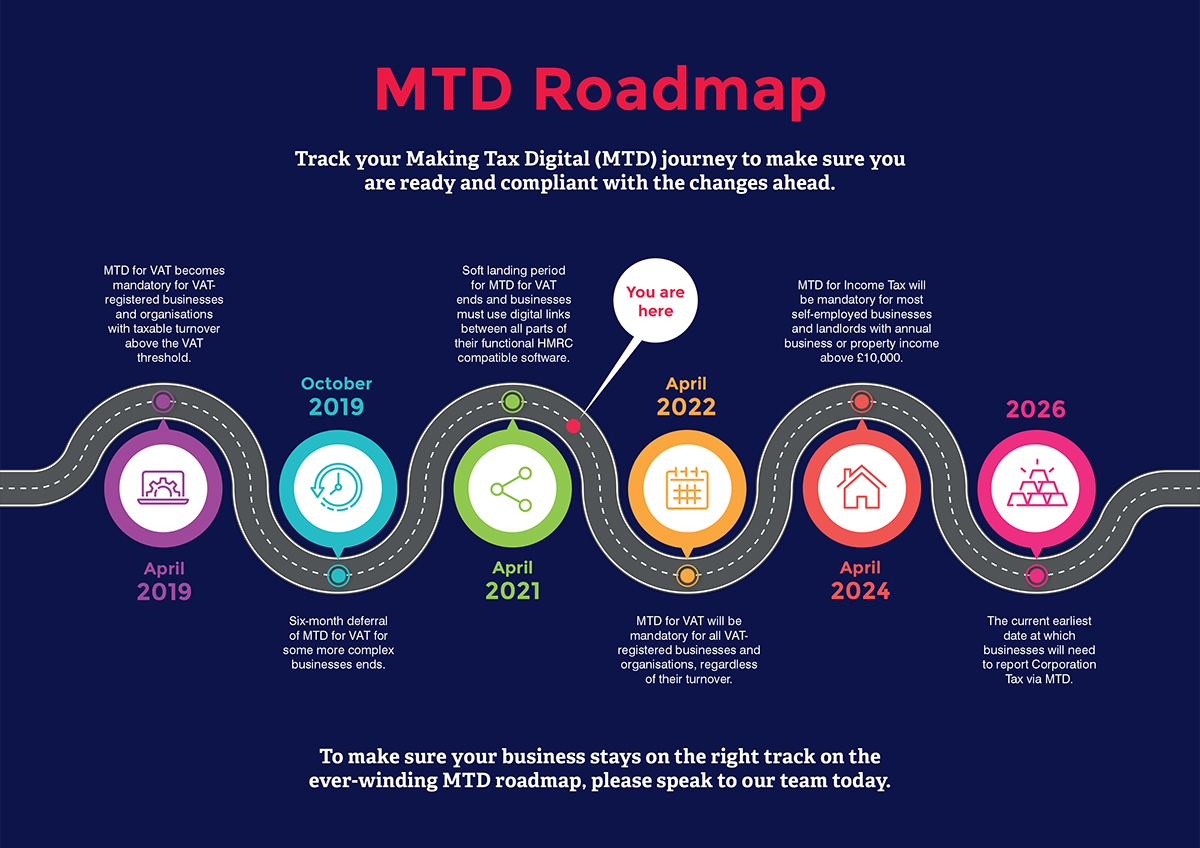

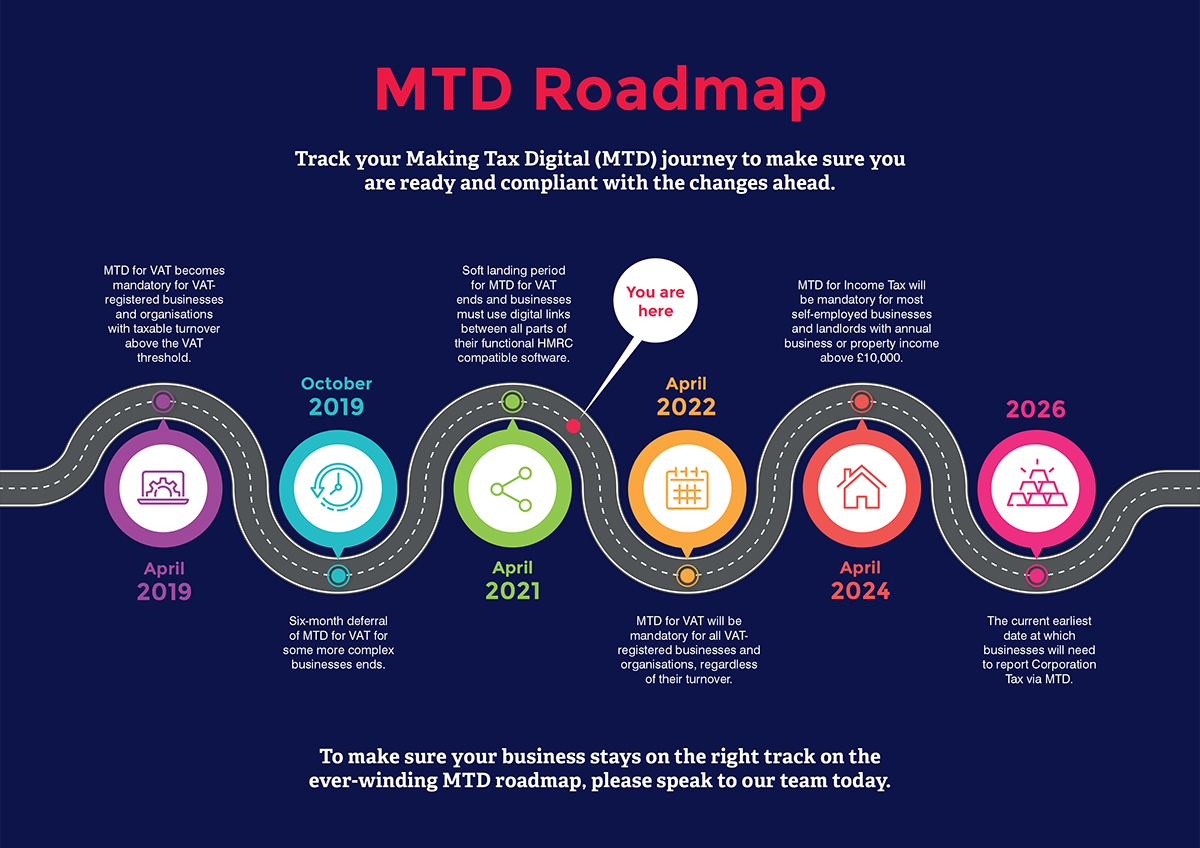

- VAT return preparation and submission through Making Tax Digital

- Limited company accounts, including full and abbreviated accounts, and corporation tax return

- Sole trader accounts and partnership accounts, including LLPs

- Personal tax returns

Payroll

Our payroll services include:

- Setting up of PAYE schemes

- Running of your payroll throughout the tax year

- Payslips

- Advice as to payments to HMRC

VAT

We can help you with your VAT requirements, including:

- Preparation and submission of quarterly VAT returns

- Advice on the benefits of VAT registration

- Online submission of VAT returns through Making Tax Digital

Making Tax Digital

We can help you with your obligations under Making Tax Digital, including:

- Advice on the relevant tax legislation

- Assistance with online submission to HMRC

- Complete Set-up Guidance